As the UK recovers from the COVID-19 coronavirus pandemic and heads into a potential economic depression or even a recession, can you still start a new successful business in a challenging trading environment? Business and technology expert Dave Howell of Nexus Publishing reports.

The current pandemic is a challenging environment to start a new business, but if you have a great idea, should you move forward with your plans? Will you have the financial support your new enterprise needs? And, are consumers waiting to buy your goods or services?

Starting Businesses in Recessions Presents Opportunities For the Young and Home-Based Entrepreneurs

It’s a myth that an economic downturn or a recession is the worst time to start a new business. Many of the world’s most successful companies were founded within economically challenging trading environments. Microsoft, FedEx and Burger King are all great examples.

Also, the entrepreneurial spirit is alive and well in the UK. According to research from SME Loans, 64% of the UK workforce wants to set up a business with 83% of 18-24-year olds dreaming of self-employment, with London, Yorkshire and West Midlands being the UK’s capitals of aspiring entrepreneurs.

And research from High-Speed Training – a digital learning provider defines the rise of the ‘homepreneur.’ Sign-ups for their ‘Starting a Business’ online course increased by two thirds (61%) in the first six weeks of lockdown, compared to the same period last year.

Dr Richard Anderson, Head of Learning and Development at High-Speed Training, said: “The teeth of a recession can actually be the ideal time for innovators and entrepreneurs to create and launch their startups.

Economic downturns have previously shown that new businesses can gain market opportunities and provide income for those struggling to secure, or who’ve lost, their job. The lockdown may provide an opportunity for homepreneurs to use their physical-distancing time to pick up a new skill or create a business plan to launch an Etsy shop or consultancy from their kitchen table.”

The Coronavirus Effect and Redundancies

Many businesses have reacted to COVID-19 by rationalising their businesses. This has meant redundancies, but for anyone starting a new enterprise, this can mean a ready and waiting workforce of highly skilled workers, your new venture can take advantage of.

How we all work and shop will see profound changes. For new businesses, this isn’t a barrier but an opportunity. Where your new business trades can also be critical to get right. Clearly, the online channel continues to expand. Indeed, according to research from Growth Intelligence, 85,000 businesses launched new online stores over the past four months.

Tom Gatten, CEO of Growth Intelligence, said: “It’s remarkable to see the speed at which small businesses across the country have adapted. Being unable to trade in the traditional sense has been a catalyst in driving digital transformation. Where one door has closed, this nation of shopkeepers has forced another to open.

“Thousands of businesses are making the most of the tremendous opportunity that growing demand for online shopping is creating. While our data shows a very slow return to what we previously considered ‘normal’, the new environment is opening new markets and this will reinvigorate the economy.”

Your new business can innovate at speed. Your new services or inventions can be products of a post-COVID-19 world, but not exclusively. Technology will be a great enabler here. And from an economic point of view, borrowing money will be very cheap as interest rates could continue to fall. Many small businesses, though, will be founded with money from family or friends or via the buoyant crowdfunding space.

Simon Squibb, entrepreneur and angel investor, told Teneric: “Think about what people need. Review the new habits being formed and think about how your business can solve pain points and be of use to this changing world.

I have always said that in an ideal world everyone would be self-employed and be free to decide their own destiny. Perhaps consider that this difficult time could be your opportunity, and even a lucky time in your life in an odd way; a chance to reflect and explore who you really are and what you really want from your business life.”

An Example of a Thriving Business Born During COVID-19

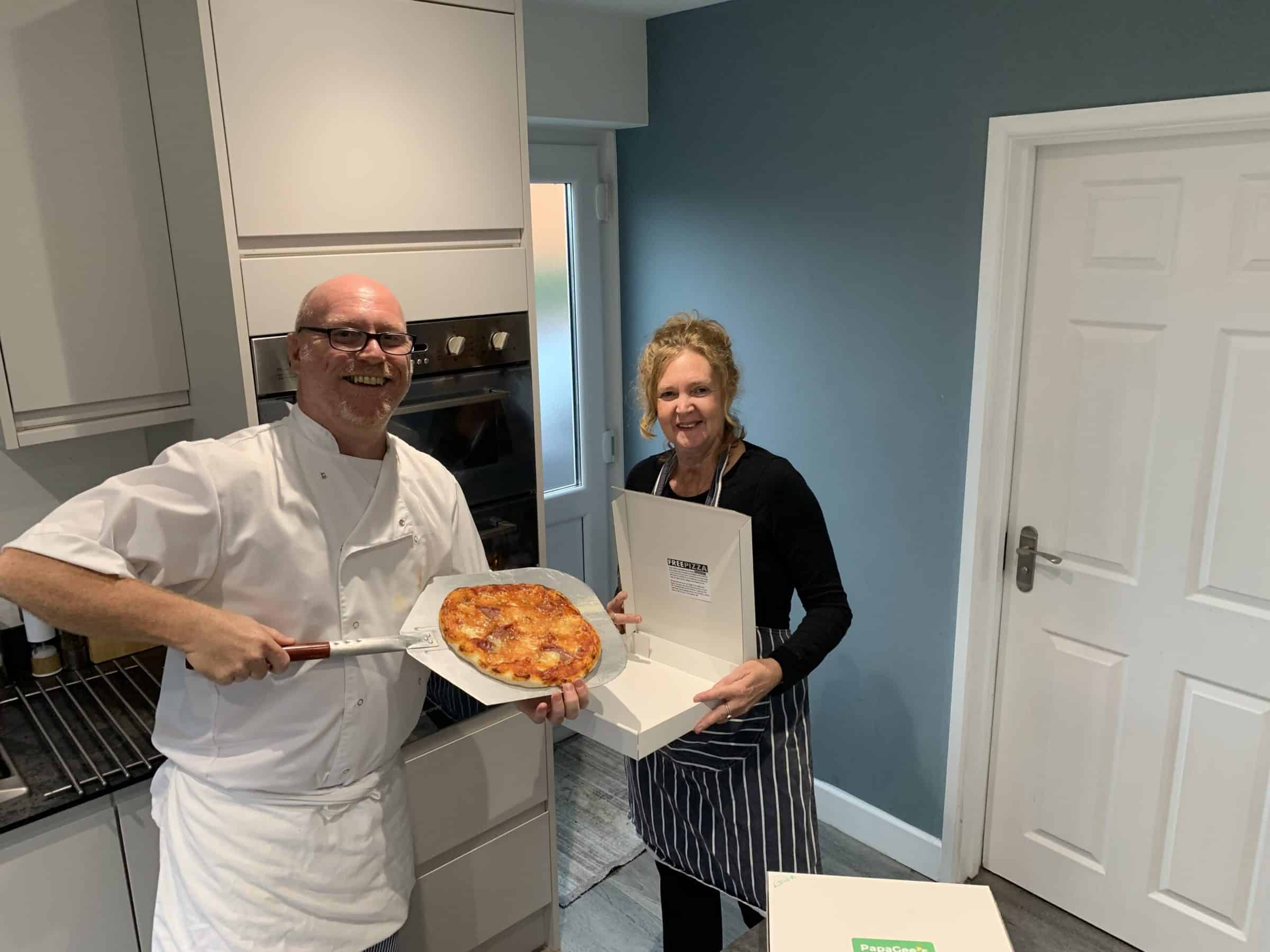

To gain an insight into how an economic downturn or recession that appears to be a disastrous trading environment can actually deliver a great opportunity, Teneric spoke with Rachael Willoughby who started a pizza making and delivery business this April having lost 50% revenue of from her software development company the day after the lockdown was announced.

Rachael Willoughby and her partner cooking the latest batch of pizzas. PapaGees has gone from strength-to-strength, proving you can start a successful business no matter the economic environment.

She and her partner had intended to start a totally different business – Cotswold Campers (hire of motorhomes) but fortunately were unable to find a suitable motorhome, as this would have been sat on the drive for several months! Necessity is the mother of invention, so Rachael pivoted her plans to create a totally different business that is thriving.

You started your business in April just as the pandemic hit and lockdown happened. How have these events impacted your business planning?

“Our business PapaGees was started as a result of lockdown because we recognised that people would still want to treat themselves and, as they couldn’t go to a restaurant near them, takeaway seemed the obvious solution,” Rachel explained. “We chose pizza takeaway because firstly, we’ve been making pizzas for family and friends for years, and secondly, there was a lack of authentic Italian style pizzas in the area.

“Our current company Squareone Software took an immediate 50% hit in income when the lockdown was announced as our two major clients had their businesses suspended or limited. We had to move fast to put in place something to replace that lost income.

“We had originally planned at the beginning of 2020 to open a business called Cotswold Campers to hire out a motorhome. However, we were unable to find a suitable vehicle. Then lockdown happened. It made no sense to continue down this route. So, PappaGees was born. Actually, we now intend to use the profit from PapaGees to help finance a vehicle so ultimately, we will have a better cash flow once we move on that business. We expect a huge surge in staycations for 2021 and so intend to launch March 2021.”

Have you found pivoting to a new business has been successful for you?

“Pivoting to a new business from a service-based business to a product has been surprisingly easy. We applied all the marketing techniques we were using for Squareone to PapaGees. Reputation has always been extremely important to us. We carried this over by making sure we offered a fantastic consumer service with our pizzas.

“It certainly helps that we can create all our own marketing materials especially the website. Pivoting (albeit unexpectedly) has just added another income stream so we are no longer reliant on getting a constant supply of new web customers. The nature of the business also means cash flow is no longer an issue.”

Do you think it doesn’t matter what is happening with the economy as long as the demand for your goods or services is present?

“It is definitely possible to survive and even thrive in a recession providing firstly there is a demand for what you are offering. Secondly you are prepared to invest in marketing. So many businesses make the mistake of cutting their marketing budget in a recession. And lastly, you give excellent customer service so people come back.”

How do you plan to build and expand your businesses into the future?

“Originally we though PapaGees would just be a temporary thing during lockdown but demand for our pizzas has not decreased even though restaurants are now open. So, we plan to continue and, we’re considering how to franchise this because it’s a perfect business model for someone who may have lost their job who enjoys cooking. You could get up and running and trained within a couple of weeks. Clearly unemployment is going to rise significantly over the next couple of months and therefore, buying into a readymade franchise has appeal.”

If you have had a burning desire to start your own business, now could be the perfect time to put your plans into action. Innovating with new business models will become commonplace.

Many firms are assessing how they operate, their supply chains and the communications channels they use to reach their customers, because all these essential business components have all been massively disrupted as the pandemic took hold. New businesses will need to innovate with new approaches as enterprises and consumers alike, adapt to the new normal.

Whatever your current circumstances, if you have an ambition to become your own boss, what are you waiting for? There is masses of help and support available to help you start your journey.

A Chartered Accountants View on Your New Business

Ercan Demiralay FCCA, a Partner at Wellers Accountants provides some additional tips and examples of the types of businesses that thrive during recessions. Ercan works closely with high growth businesses in a wide range of sectors, including technology and media. His advice could assist when writing your business plan for your new venture.

Can an economic downturn, or even a recession, be an excellent time to start a business?

“Recessions quite often test nations and consumers to try and do the same or more but with less resource. In that sense, downturns result in challenges or issues that need to be addressed. This is potentially a perfect environment for entrepreneurs to use their ideas and innovation to produce solutions and therefore, businesses to address such matters.

“Startups by their very nature are nimble, operate on tight budgets with limited access to a resource which can be advantageous over larger competitors used to operating with vast cash piles and corporate structures that require multiple layers of buy into decision making.

“Businesses formed during recessions soon become used to operating in an environment of tight budgets and cost controls. This fiscal discipline means the company will be well placed to maximise profit margins when the economy emerges from the downturn.

“Recessions, by their very nature, can be quite deflationary, and this creates opportunities for the right businesses to purchase assets and acquire personnel at prices that represent excellent value for money.”

What type of new businesses are profitable during an economic downturn?

“Recession-proof businesses do exist. While the term isn’t wholly accurate as any organisation that is poorly run can risk going bankrupt, some industries are better geared to weather an economic storm.

“The following sectors are likely to do quite well despite the economic pain:

Alcoholic beverages

Restaurants, pubs, and hotels have taken a huge hit from the COVID-19 lockdown. However, wholesalers or beer, wine, and spirits will likely have done well to make up for the shortfall in the eating and drinking out market.

Bulk staple foods and essential house items

As witnessed during the lockdown, when times are tough people tend to buy essential items in bulk to make use of potential discounts for such purchases. Think of things such as flour, sugar, milk, eggs, and detergents, to name a few.

Accountants and tax advisors

In a recession, business owners often find themselves in the position of needing to budget carefully and monitor spend. Who better than an accountant to help you install financial discipline in your business by monitoring performance? They can also advise you on making use of available tax reliefs and thereby potentially save money.

Debt collection

Recessions tend to be a time when the level of debt and the ability to pay it down comes into sharp focus by lenders. It’s the mass inability to settle liabilities makes debt collection work soar during a downturn.

Vehicle repairs

People tend to budget and scrip during a recession and will avoid big item expenditure wherever possible. They won’t buy a new car and may delay or even forgo on the annual service as they try to keep their cars running a minimal cost. The net result, vehicles break down or need attention and repairs like never before.

House repairs

The same is true for general repair services; again, people will look to repair rather than purchase something new – things such as plumbing issues, drainage, appliances, and patching up a leaking roof.

Tutoring and training

As recession kicks in, people often train themselves up in new skills to boost their employability. Various tutors, therefore, become more in demand. Furthermore, online tutoring now makes the provision of this service easier than before.

Are the approach new business owners should take different when setting up their enterprises in an economic downturn than in an economically buoyant trading environment?

“In an economic downturn, investors and banks are usually far more risk averse. Hence, access to funding will be very tough for startups that often rely on angel investors or friends and family to help out early on until cash flow starts to cover their outgoings.

“The approach needs to be different in terms of strict budgeting and controls to ensure the business does not overspend and can operate effectively. Another essential factor would be to ensure the product/market fit is already there and that the project is not speculative as in a downturn people usually stick to what they know and unlikely to take risks and experiment with new ideas that could cost money and time.”

How will COVID-19 impact on how new small business are started during the rest of 2020?

“Many businesses operate on what they expect the big picture for their economy and sector will be. Their budgets tend to be based on how they expect the year to go.

“Forecasting in this environment is challenging. For many new, small businesses, social distancing and public concern over getting ill mean it will take many months, maybe even years, for sales to return to prior levels. Owner managers will have to assess carefully how their customers have been impacted financially by the virus. Face-to-face meetings with customers and accessing industry research could help them formulate what the big picture is likely to look like.

“This then needs to be narrowed down to what sales will look like on a week by week and month by month basis. This will likely determine if there is sufficient demand for their products or services and therefore if they can either startup or continue to trade.

“It doesn’t just end with sales. However, while demand may be reduced, the reality is the need for social distancing, cleaning, and PPE will drive up the costs of doing business. This, in turn, could impact profoundly on margins. Entrepreneurs need not just to understand likely demand but also whether they can achieve profits on the sales that they do actually make.”

What are the key operating metrics to keep an eye on as you operate your new business through a recession or an economic downturn?

- Turnover

- Top selling products/services.

- Average order value – how much do customers spend on average when visiting your business, stores, and/or website?

- Cash flow and working capital and the working capital formulaare essential to understand.

- Debtors list and unpaid invoices.

- Gross profit margin.

- Return on capital employed.

- Source of revenue – in-store vs delivery.

Will social enterprises become a key driver in the small business development post-COVID-19?

“We have seen during the pandemic and especially in the early lockdown days that social enterprises have been heavily influential and effective to serve local communities and those in need. People have become more responsive to helping each other out, and social media has been full of praise and marketing for such enterprises.

“It is, therefore, very likely that this will shape demand and supply in some sectors. Therefore, small businesses need to understand what impact this will have on their business and whether they can partake in the movement, both for profits but also for philanthropy in general.”